Table of Contents

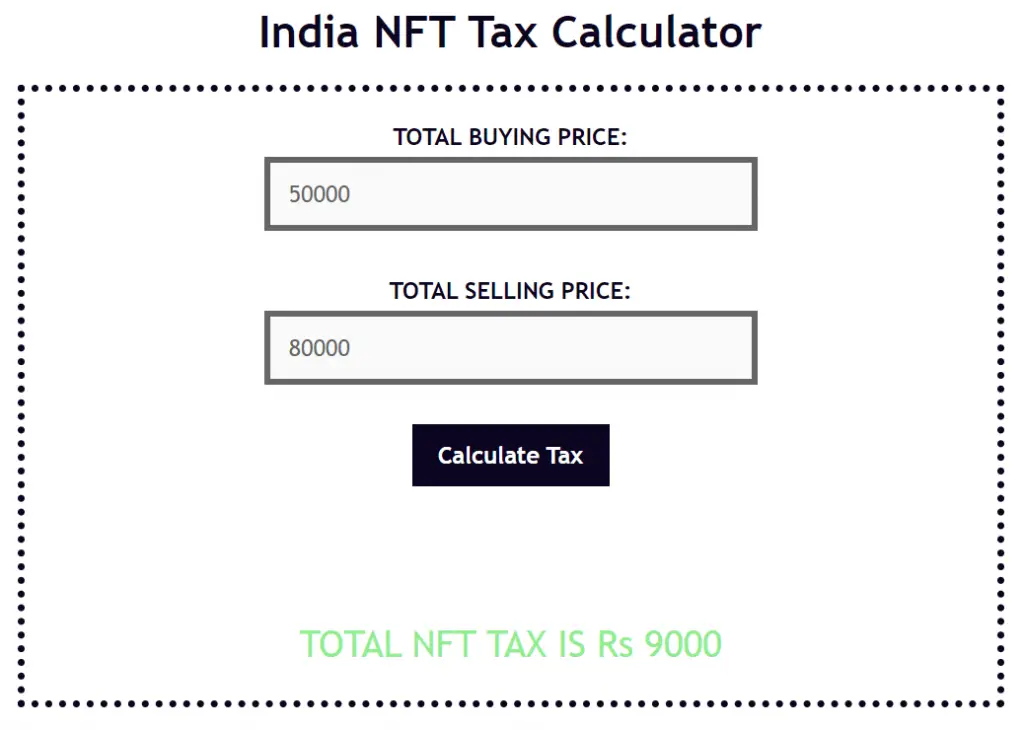

India NFT Tax Calculator

TOTAL SELLING PRICE:

How To Use The India NFT Tax Calculator

Following are the steps to use the above NFT tax calculator for India:

- Enter your total buying price of all the NFTs that you acquired.

- Enter your total selling price of all the NFTs that you sold.

- Finally, click on the “Calculate Tax” button to compute your NFT tax liability.

Here’s an example:

Also check out: India Crypto Income Tax Calculator

More Information About NFT Tax In India

Income from any digital asset, including NFT, is taxed at 30% in India as per the Budget of 2022, declared by the Government of India.

The 30% tax is applicable when an Indian tax payer sells his/her NFTs. The cost of aquisition of the NFT shall be deducted during the computation of the income tax.