Table of Contents

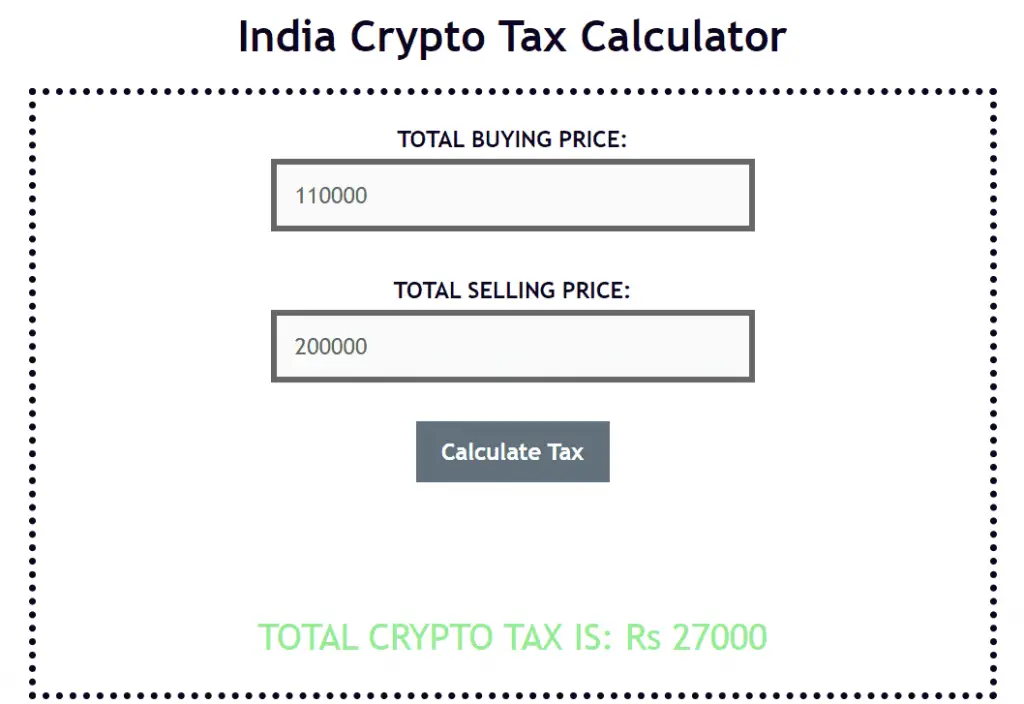

India Crypto Tax Calculator

TOTAL SELLING PRICE:

How To Use The India Cryptocurrency Tax Calculator

Following are the steps to use the above Cryptocurrency tax calculator for India:

- Enter your total buying price of all the cryptocurrencies that you acquired.

For example, if you bought Rs 50,000 worth of Bitcoin (BTC) and Rs 60,000 worth of Dogecoin (DOGE), enter “110000” in the “Total Buying Price” input field. - Enter your total selling price of all the cryptocurrencies that you sold.

For example, if you sold Rs 80,000 worth of Bitcoin (BTC) and Rs 1,20,000 worth of Dogecoin (DOGE), enter “200000” in the “Total Selling Price” input field. - Finally, click on the “Calculate Tax” button to compute your crypto tax liability.

Here’s an example:

Also check out: India NFT Income Tax Calculator

More Information About Cryptocurrency Tax In India

The Government of India on February 1st 2022, in its budget 2022, imposed a 30% tax on income from digital assets, including cryptocurrencies and NFTs.

The 30% tax is applicable when an Indian tax payer sells his/her digital assets like Bitcoin, Dogecoin, Ethereum, NFTs, etc. The losses incurred while trading any digital asset cannot be offset against any other income.

Only the cost of acquisition shall be allowed as deduction while computing the income from digital assets like cryptocurrencies and NFTs.